Common Reporting Standard (CRS) has had a tremendous impact on planning for both domestic and international families with asset protection and privacy concerns. Very similar to FATCA, CRS is a powerful tool that is designed to reduce tax evasion and illegal financial activity by imposing very strong transparency rules and disclosure requirements relative to financial transactions.

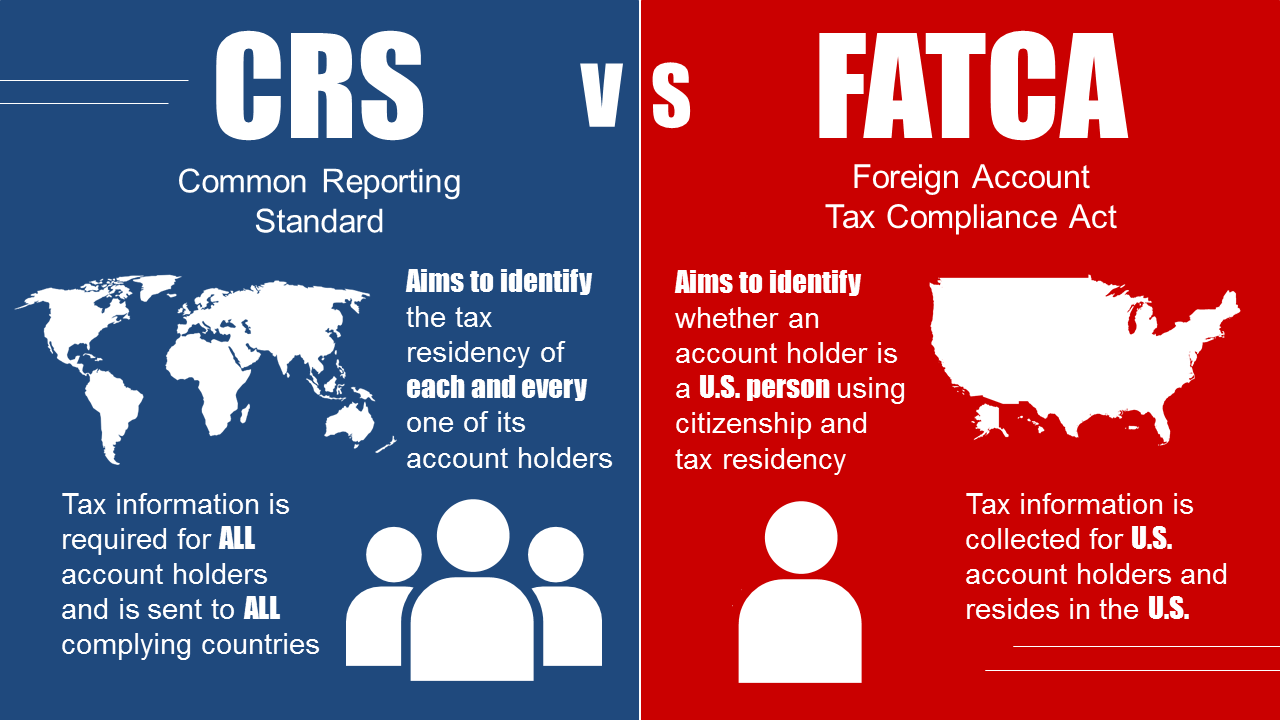

While the reporting requirements of CRS and FATCA are similar, FATCA focuses on collecting information from individuals only holding U.S. based accounts, and such information is not shared with other countries. CRS is broader in scope, seeking global cooperation and the sharing of financial information between and among participating jurisdictions, with enhanced transparency in multi-national business and investment reporting. To date, well over 100 countries have committed to implement CRS, including jurisdictions traditionally used by families with privacy and asset protection concerns such as Switzerland, Cooks Islands, BVI, Nevis, and New Zealand.

The United States has not signed on to CRS, prompting many planners, academics, and industry publications to consider the United States as both a tax and privacy haven. On May 16, 2016, Financial Times stated “America is the new Switzerland,” and the Washington Post stated on April 5, 2016, that “The United States is now becoming one of the world’s largest tax and secrecy havens.” The Daily Business Review, on April 25, 2017, stated that “The United States has become a place of choice for foreign investors.”

Because of CRS, and a myriad of other reasons, the financial services industry has seen a tremendous influx of international families coming to the Unites States, and to South Dakota in particular, to avail themselves of very strong privacy and asset protection provisions, and to take advantage of South Dakota’s status as a no state income tax state (to learn more about the power of South Dakota trust law, click here for a detailed information piece). This reality places a tremendous responsibility on financial institutions to perform very thorough due diligence, and to put very copious Know Your Customer (KYC) programs in place. In addition, it is imperative that the U.S. financial planning industry, as a whole, act responsible when planning for and working with international families, clearly differentiating between providing privacy solutions and NOT secrecy, and engaging in appropriate tax planning and NOT tax evasion.

Understanding the vital importance of issues around international families coming to the United States, the South Dakota Division of Banking is proactively working very closely with trust companies such as Bridgeford Trust working in the international space to develop uniform regulations designed to protect against nefarious actors and to protect the overall integrity of the South Dakota trust industry. Bret Afdahl, Director of the South Dakota Division Banking stated, in a May 16, 2017, Financial Times article, “We are the chartering authority and, if something goes wrong, we own it. From a reputational standpoint, no one benefits from having something bad happen.”

Below is short video about CRS and how Bridgeford Trust is well positioned to responsibly and diligently work with international families.

For more information about CRS or how Bridgeford Trust can partner with international families coming to the United States and their advisors, please contact us via our contact page.

You can also learn more about this issue by clicking here for a recent webinar entitled “A Tax and Privacy Haven: Coming to America” that was originally produced on Thursday, September 7, 2017.