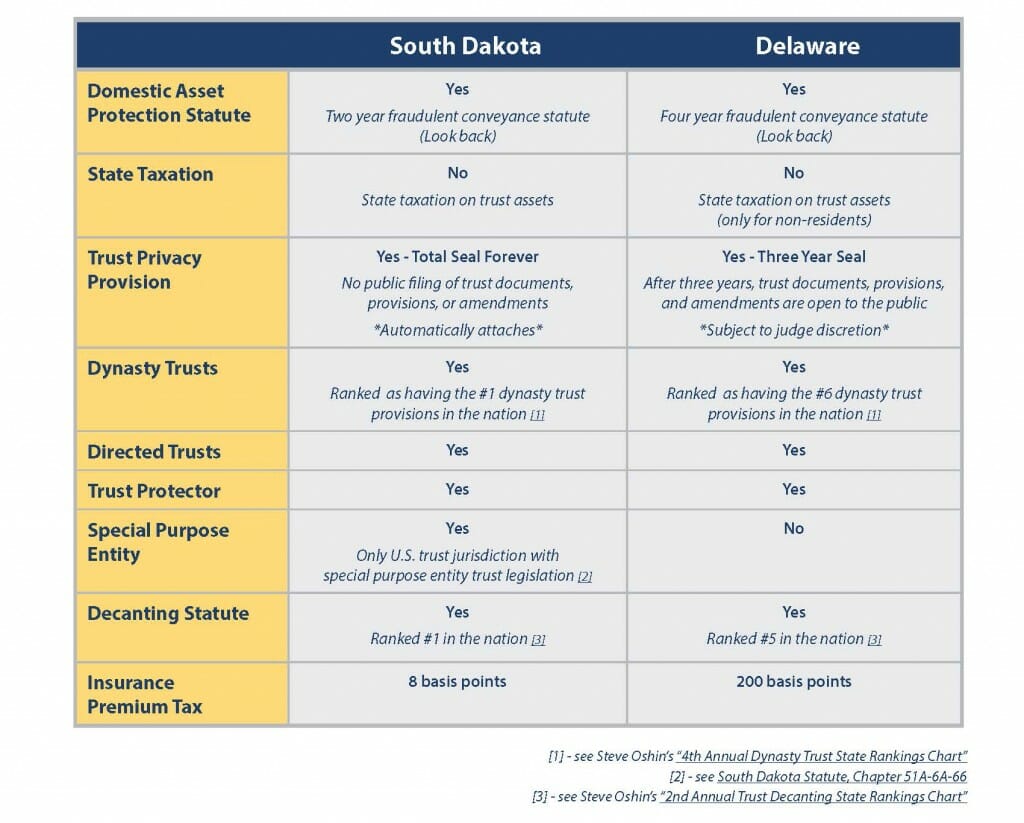

Modern trust laws, available in progressive trust jurisdictions such as South Dakota, have drastically changed the trust and wealth planning landscape bringing far more control and flexibility to settlors, advisors, and beneficiaries than ever before. Concepts such as the directed trust, decanting, and the trust protector have tremendously changed traditional notions around irrevocable trusts, and how they are drafted and administered.

Modern trust laws, available in progressive trust jurisdictions such as South Dakota, have drastically changed the trust and wealth planning landscape bringing far more control and flexibility to settlors, advisors, and beneficiaries than ever before. Concepts such as the directed trust, decanting, and the trust protector have tremendously changed traditional notions around irrevocable trusts, and how they are drafted and administered.

Click here for a detailed description of these modern trust laws, and a discussion around the huge impact they are having on modern wealth planning.

Bridgeford Trust will be presenting at the upcoming Global Financial Summit, an exclusive, private wealth conference taking place at the Atlantis Resort & Casino in the Bahamas from March 16-19. The conference is produced by noted economist and award-winning financial advisor, Mark Skousen, and includes presentations from an elite team of highly successful wealth managers, financial gurus, economic forecasters, and geo-political analysts. Presenters will offer an experienced perspective on wealth-building and asset protection, offshore investing opportunities, financial privacy, and investment strategies.

Bridgeford Trust will be presenting at the upcoming Global Financial Summit, an exclusive, private wealth conference taking place at the Atlantis Resort & Casino in the Bahamas from March 16-19. The conference is produced by noted economist and award-winning financial advisor, Mark Skousen, and includes presentations from an elite team of highly successful wealth managers, financial gurus, economic forecasters, and geo-political analysts. Presenters will offer an experienced perspective on wealth-building and asset protection, offshore investing opportunities, financial privacy, and investment strategies. South Dakota is once again ranked, for the third time in a row, as having the top decanting statute in the nation! Published by Nevada attorney Steve Oshins, the new

South Dakota is once again ranked, for the third time in a row, as having the top decanting statute in the nation! Published by Nevada attorney Steve Oshins, the new  Bridgeford Trust Company will be attending the 50th Annual Heckerling Institute on Estate Planning from January 11-15 in Orlando, Florida and co-sponsoring a cocktail reception on January 13 celebrating the power and sophistication of South Dakota’s trust laws.

Bridgeford Trust Company will be attending the 50th Annual Heckerling Institute on Estate Planning from January 11-15 in Orlando, Florida and co-sponsoring a cocktail reception on January 13 celebrating the power and sophistication of South Dakota’s trust laws. Commentators and advisors continue to debate whether offshore asset protection trusts, available in jurisdictions such as Nevis and the Cooks Island, are better asset protection vehicles than U.S. domestic asset protection trusts, available in a small number of states including South Dakota. The debate is typically fueled by esoteric legal distinctions and hyperbole or, more commonly, based upon a subjective planning bias of the particular advisor. Unfortunately, the debate does not always serve a client interested in obtaining asset protection well, as they are often left confused and uncertain as to what is the best option. However, a South Dakota statute appears to create the opportunity to bring both offshore and domestic asset protection strategies together in one trust instrument, thereby providing a solution that brings the “best of both worlds” to the asset protection planning space.

Commentators and advisors continue to debate whether offshore asset protection trusts, available in jurisdictions such as Nevis and the Cooks Island, are better asset protection vehicles than U.S. domestic asset protection trusts, available in a small number of states including South Dakota. The debate is typically fueled by esoteric legal distinctions and hyperbole or, more commonly, based upon a subjective planning bias of the particular advisor. Unfortunately, the debate does not always serve a client interested in obtaining asset protection well, as they are often left confused and uncertain as to what is the best option. However, a South Dakota statute appears to create the opportunity to bring both offshore and domestic asset protection strategies together in one trust instrument, thereby providing a solution that brings the “best of both worlds” to the asset protection planning space.

David Warren, President and CEO of Bridgeford Trust, is going to be featured on WEEU 830AM on Tuesday, December 1, 2015 from 6:00pm-7:00pm.

David Warren, President and CEO of Bridgeford Trust, is going to be featured on WEEU 830AM on Tuesday, December 1, 2015 from 6:00pm-7:00pm.