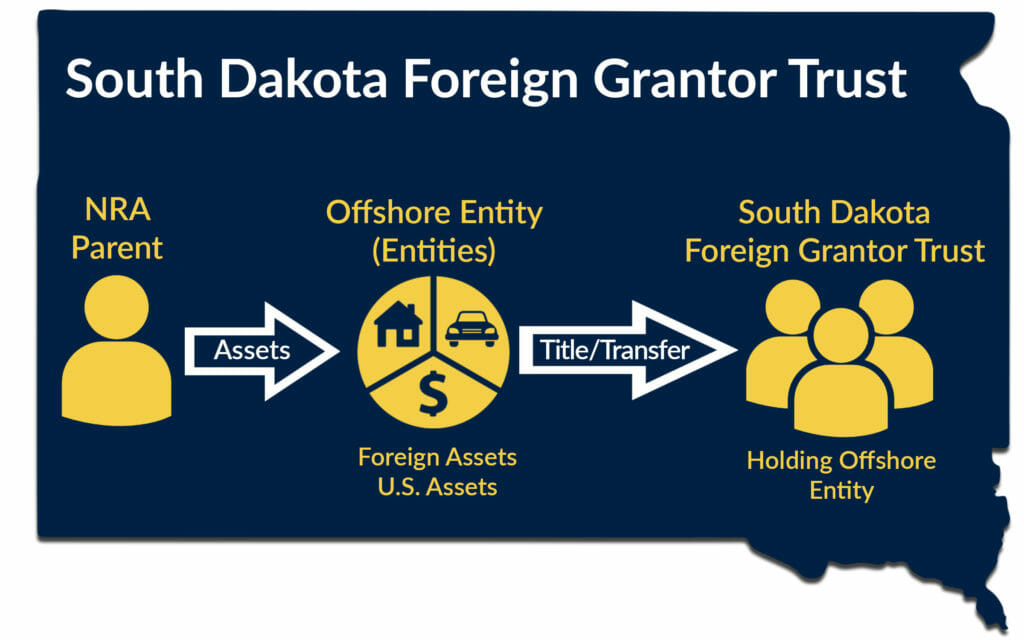

For a myriad of reasons, including privacy and asset protection, wealthy families from around the world are seeking U.S. trust solutions. Because of the power and sophistication of its trust laws, international families are increasingly selecting South Dakota for trust situs of Foreign Grantor Trusts.

Through appropriate planning and drafting, a South Dakota Foreign Grantor Trust may be established as a “foreign” trust for U.S. tax purposes and therefore treated the same as an offshore trust, while availing itself of powerful U.S. trust laws. Failure of the “Court Test” or “Control Test,” as outlined by the IRS, will result in the trust being treated as a non-U.S. entity and therefore not subjecting it to U.S. Taxation. Since the trust is considered a South Dakota trust for legal purposes, the state’s industry leading dynasty trust, asset protection, and privacy laws may also be incorporated into the trust.

Compelling aspects about South Dakota trust law that render it the U.S. trust jurisdiction of choice for international families include that fact that the state has consistently been ranked as the top U.S. dynasty trust state and its decanting statute has consistently been ranked as the most progressive in the nation. In addition, South Dakota has the strongest privacy provisions and one of the most powerful domestic asset protection statutes in the nation, as recently observed by Trust & Estates magazine. Consistently recognized as an innovator in the trust industry, South Dakota is also one of only three states with a Community Property Trust statute, a very powerful tax planning tool, and the only state in the nation with the Family Advisor role, referred to as a “trust protector light.” Click here to view a chart comparing the leading U.S. trust jurisdictions, with a particular emphasis on these areas that clearly distinguish South Dakota as the superior U.S. trust jurisdiction.

For more information about Foreign Grantor Trusts, please click here or contact us via our contact page.