The Insurance Premium Tax is a commonly missed state tax planning opportunity when utilizing insurance, particularly private placement insurance (PPLI). Essentially, the Insurance Premium Tax is a tax that is levied upon insurers, both domestic and foreign, for the privilege of engaging in the business of providing insurance in the state. The tax is passed to consumers through the payment of insurance premiums and it varies dramatically among states. Significant tax savings can be realized simply by purchasing a policy within a trust sitused in a state with a low Insurance Premium Tax such as South Dakota.

Most states in the country have an Insurance Premium Tax between 150 and 250 basis points.

- Nevada = 350 bps

- New York = 200 bps

- Pennsylvania = 200 bps

- California = 233 bps

- Wyoming =75 bps

While Delaware boasts 0 bps on policies owned in trust, it is very important to note that policies held within an LLC owned by the trust (which is the typical structure) are subject to a 200 bps Insurance Premium Tax.

South Dakota has the LOWEST Insurance Premium Tax in the nation at 8 bps that applies BOTH to policies owned directly by a trust AND a policy within an LLC owned within trust.

This powerful state tax planning opportunity involving insurance, available by simply selecting a low premium tax jurisdiction like South Dakota, is particularly compelling when considered in conjunction with the fact that South Dakota…

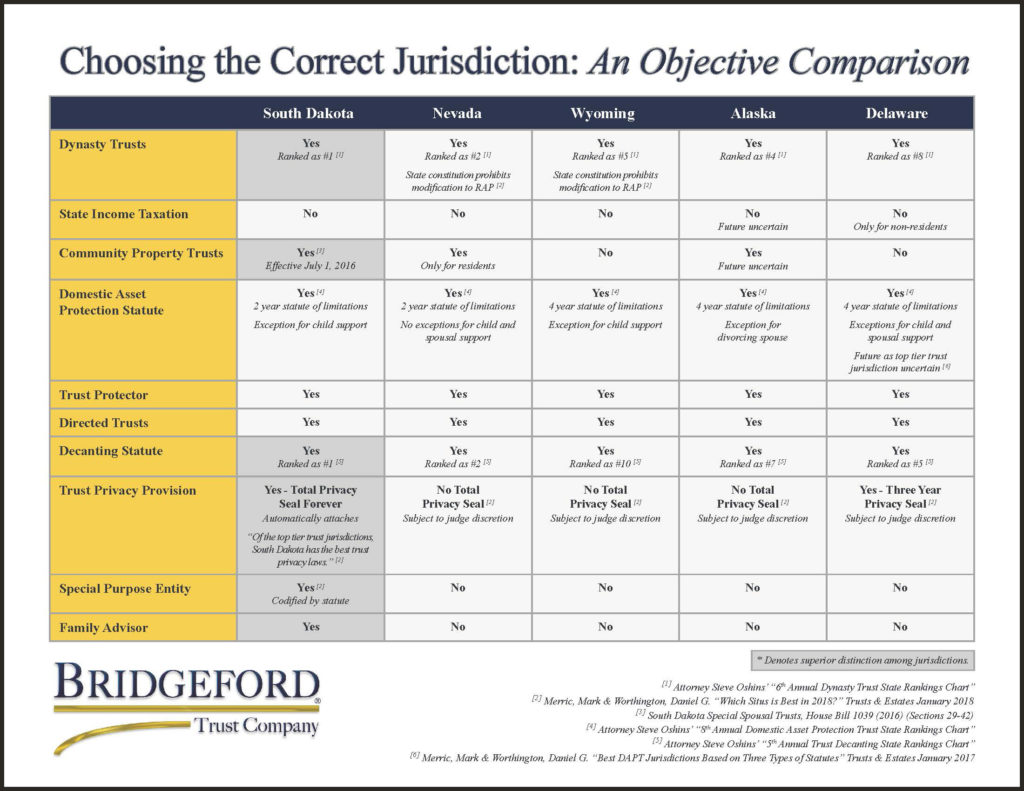

- Is generally regarded by most practitioners and academics, including Steve Oshins, as being the best Dynasty Trust state and having the strongest Decanting Statute in the nation.

- Unequivocally has the most robust privacy laws in the country, as pointed out by an article appearing in the January 2018 edition of Trusts & Estates Magazine comparing U.S. trust jurisdictions wherein the author noted, “Of the top tier trust jurisdictions, South Dakota has the best trust privacy laws.”

- Is one of only two states with a Community Property Trust, a compelling tax planning tool for spouses.

- Is the only state in the country with the Family Advisor, referred to as a “Trust Protector Light.”

For more information on the Insurance Premium Tax and how this tax planning strategy can work in your favor, please reach out to us via our contact page.