Below is a link to a recent Pennsylvania Commonwealth Court opinion (McNeil v. Commonwealth of Pennsylvania, Pennsylvania Commonwealth Department of Revenue) rejecting the Pennsylvania Department of Revenue’s attempt to impose an income tax on “resident trusts.” A resident trust is one created under the will of a decedent who was a Pennsylvania resident at the time of death or a lifetime “grantor” trust established by a Pennsylvania resident. Regardless of where the trust is sitused (which state has jurisdiction), under Pennsylvania law, the trust remains subject to Pennsylvania income tax even if the settlor, trustee, or beneficiaries do not have any contact with Pennsylvania. The McNeil case involves two trusts that were established by a Pennsylvania resident with a corporate trustee in a state that does not impose income tax on trusts. All of the assets in the McNeil case were located outside of Pennsylvania and the trust did not derive any income from a Pennsylvania entity. The Court concluded Pennsylvania’s law violated the Commerce Clause of the Constitution because there was not sufficient contact with Pennsylvania to justify the imposition of the tax.

Below is a link to a recent Pennsylvania Commonwealth Court opinion (McNeil v. Commonwealth of Pennsylvania, Pennsylvania Commonwealth Department of Revenue) rejecting the Pennsylvania Department of Revenue’s attempt to impose an income tax on “resident trusts.” A resident trust is one created under the will of a decedent who was a Pennsylvania resident at the time of death or a lifetime “grantor” trust established by a Pennsylvania resident. Regardless of where the trust is sitused (which state has jurisdiction), under Pennsylvania law, the trust remains subject to Pennsylvania income tax even if the settlor, trustee, or beneficiaries do not have any contact with Pennsylvania. The McNeil case involves two trusts that were established by a Pennsylvania resident with a corporate trustee in a state that does not impose income tax on trusts. All of the assets in the McNeil case were located outside of Pennsylvania and the trust did not derive any income from a Pennsylvania entity. The Court concluded Pennsylvania’s law violated the Commerce Clause of the Constitution because there was not sufficient contact with Pennsylvania to justify the imposition of the tax.

You can view the Pennsylvania Commonwealth Court opinion by clicking here.

This is a very important case that proves once again that trust jurisdiction matters in the wealth planning process and that jurisdiction should not be ignored by the planning community. There are a handful of states, including South Dakota, that do not impose income tax on trusts. Pennsylvania, based upon the McNeil case, can no longer impose income tax on resident trusts that hold assets outside of the Commonwealth such as securities held by custodian outside of Pennsylvania or real estate located in another state. This creates a compelling planning opportunity for Pennsylvania residents. Specifically, establishing a trust in a state or changing trust jurisdiction to a state that does not impose an income tax on trusts can have powerful short and long term financial advantages, particularly for large trusts that do not distribute much or any income to beneficiaries.

In light of this recent ruling, now is an excellent time for advisors to consult with their clients to review wealth plans and explore the benefits of establishing or moving a trust to a state that does not impose income tax on trusts.

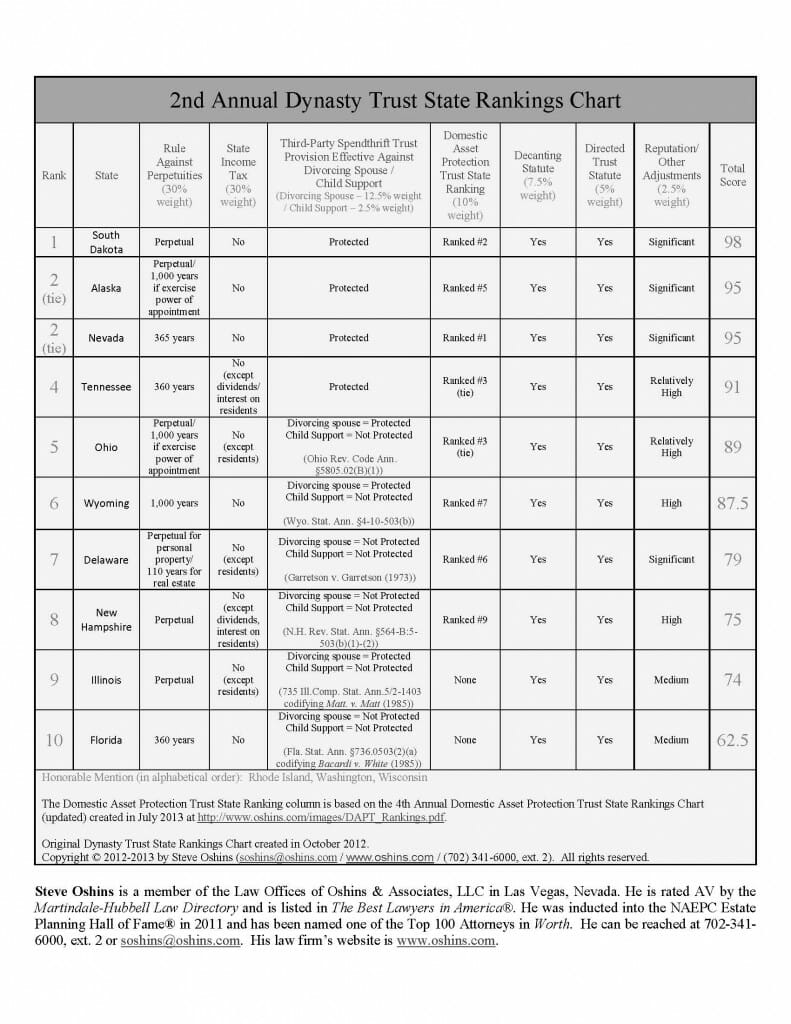

See below for a great chart published by Nevada attorney Steve Oshins, which is an excellent resource for comparing Dynasty trust states that do not impose income tax on trusts. You can click on the image below to see it in full view.