For the 4th consecutive year, South Dakota is ranked as being the top Dynasty Trust State in the nation while Delaware, long considered a top tier trust jurisdiction, slips to the 6th position behind Wyoming. A Dynasty Trust, not available in all states, is a powerful planning tool that essentially allows a trust to live in perpetuity (forever), therefore never subjecting the assets to federal estate taxations through a forced distribution. South Dakota was the first state in the nation to abolish the Rule Against Perpetuities in 1983, clearing the way for the creation of the Dynasty Trust.

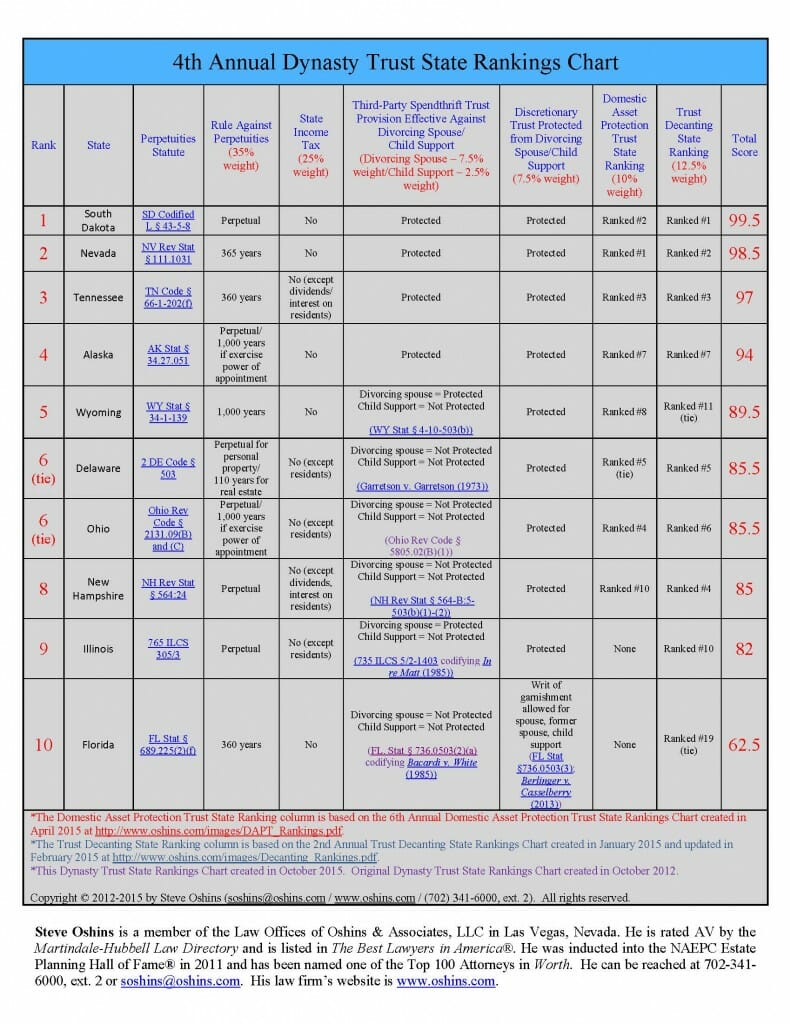

The rankings chart, an annual ranking of dynasty trust states from across the country published by Nevada attorney Steve Oshins, is an excellent resource for advisors and clients because of the methodical and objective approach to evaluating the factors that impact the viability of dynasty trust states, such as whether they have an asset protection statute and how effective it is in comparison to other states. In addition, the chart considers state taxation on trusts and whether the state has directed trust and decanting statutes. The chart accentuates the vital importance of considering alternative trust jurisdictions in the wealth and trust planning process to ensure that clients are availing themselves of the most progressive trust laws in the country, particularly in the area of dynasty trust formation, which continues to be a very hot topic.

A very important factor to consider relative to whether a dynasty trust state is the best for clients, not considered in Steve Oshins’ chart, is privacy. States have different privacy provisions protecting information contained in a trust from becoming public. Pennsylvania has no privacy provision and in Delaware, after 3 years, trust information can become public. South Dakota is the only dynasty trust state that has a total seal on trust information forever. Clearly, this is also an important factor to consider when determining where to place a trust in the wealth planning process. Click here for a detailed discussion about South Dakota’s powerful privacy provisions.

Another very important factor not considered is Oshin’s chart is the availability of the Special Purpose Entity. South Dakota is the only Dynasty Trust with legislation creating a Special Purpose Entity, a powerful planning tool that places a liability umbrella over the individuals filling the roles of trust protector, investment committee, and/or distribution committee, therefore protecting them from personal claims connected to their actions in this capacity. The Special Purpose Entity also destroys nexus between in state trust protectors, investment committee members, and/or distribution committee members, therefore maintaining the jurisdictional integrity of a resident trust with situs in a progressive dynasty trust jurisdiction like South Dakota. Click here for more detailed information on this concept.

Strong privacy provisions and the availability of the Special Purpose Entity are important planning tools that serve to support and encourage the benefits associated with selecting progressive Dynasty Trust jurisdictions for trust situs, such as South Dakota, in the wealth and trust planning process. Learn more about the progressive and cutting edge trust laws offered by South Dakota by clicking here.

Steve Oshins’ chart can be viewed by clicking on the image below.