Bridgeford Trust recently participated in a “Trust Jurisdiction Showdown” panel discussion at The Gathering, a 3-day educational conference produced by the Laureate Center for Wealth Advisors in San Diego, California. This 12th annual gathering featured experts speaking on topics in the areas of estate, business, and wealth strategies, drawing registrants from across the nation.

Bridgeford Trust recently participated in a “Trust Jurisdiction Showdown” panel discussion at The Gathering, a 3-day educational conference produced by the Laureate Center for Wealth Advisors in San Diego, California. This 12th annual gathering featured experts speaking on topics in the areas of estate, business, and wealth strategies, drawing registrants from across the nation.

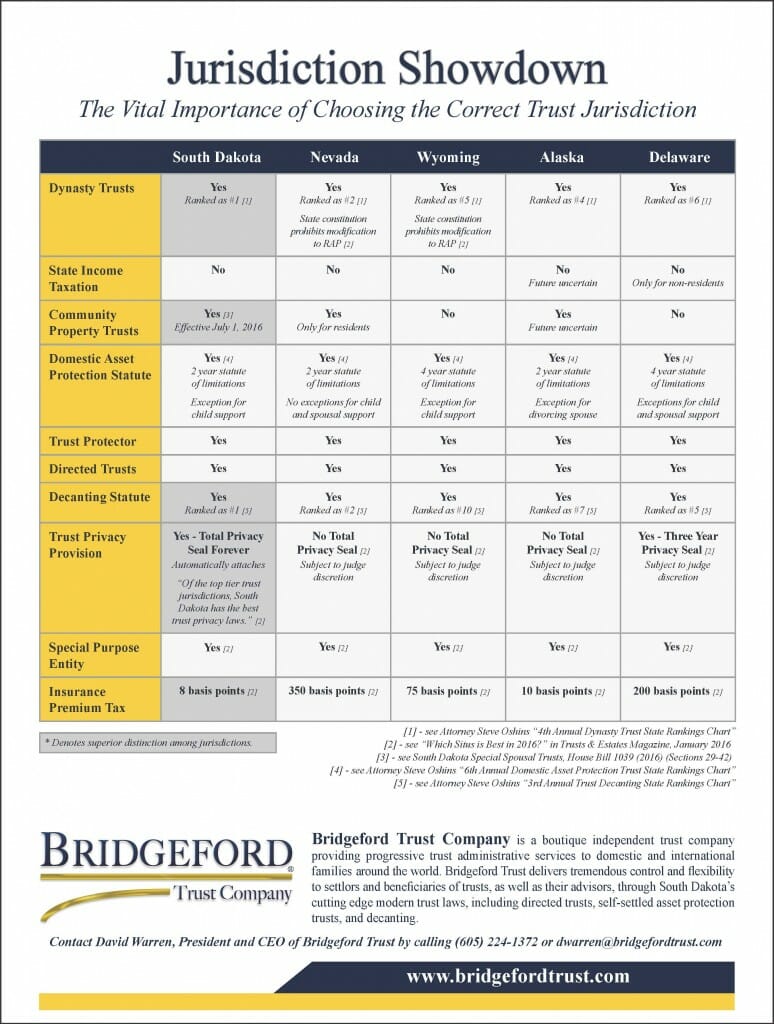

The panel included representatives from various leading trust jurisdictions including South Dakota, Nevada, Wyoming, and Alaska. The debate was spirited and very informative, focusing on attributes of each state’s trust laws. At the center of the discussion was a well-researched chart comparing the leading U.S. trust jurisdictions, with a particular emphasis on areas of trust law that clearly distinguishes South Dakota as the superior trust jurisdiction in the overall analysis. Click here or on the image below to view the chart in PDF format.

As illustrated by the shaded areas on the chart, there are five specific aspects of trust law where South Dakota excels, clearly rendering that state as the overall jurisdiction of choice for trust situs. South Dakota is generally regarded by most practitioners and academics, including Steve Oshins, a Nevada attorney, as being the best Dynasty Trust state and having the best Decanting Statute in the nation. In addition, South Dakota clearly has the most robust privacy laws in the country, as pointed out by a recent article appearing in the January 2016 Trusts & Estates Magazine comparing U.S. trust jurisdictions wherein the author noted, “Of the top tier trust jurisdictions, South Dakota has the best privacy laws in the nation.” In addition, at 8 basis points, South Dakota has the lowest insurance premium tax in the U.S. When these attributes are considered in the aggregate, South Dakota clearly emerges as the superior trust jurisdiction in the nation.

South Dakota’s newly enacted Community Property Special Spousal Trust – House Bill 1039 (2016) (Sections 29-42), recently signed by the Governor, was of particular interest during the debate and is a major differentiator when comparing South Dakota with other top tier jurisdictions that don’t have this provision in their trust law. As highlighted in a recent article, this is a very powerful state income and estate tax planning tool because it will likely allow married settlors of the trust to avoid state taxation on undistributed retained income within the trust (because South Dakota does not have an income tax) AND treats the property as community property at the death of the first spouse. Combining these benefits creates a compelling tax move that has the potential to result in very substantial federal and state tax savings, particularly if the trust is also designed as a dynasty trust, which would avoid federal estate taxation on trust assets over subsequent generations in perpetuity. In addition, the trust may also be created, in appropriate cases, to take advantage of South Dakota’s Domestic Asset Protection Trust laws for protection from creditors. At this time, the only other state with a similar statute creating a Community Property Special Spousal Trust, applying to non-residents, without a state income tax is Alaska. However, given that state’s extremely unstable financial situation and recent statements and submitted budget proposal by Alaska’s Governor Bill Walker regarding the creation of a state income tax in the very near term, it appears that South Dakota is the preferred choice for this type of trust planning primarily because of its widely known financial strength, no state income tax, and clear commitment to being the most progressive trust jurisdiction in the nation.

The lively debate at the Trust Jurisdiction Showdown proves once again the vital importance of researching and selecting the proper trust jurisdiction in the wealth planning process. Click here for more information on South Dakota’s superior trust laws. Contact Bridgeford Trust via our contact page for additional information.