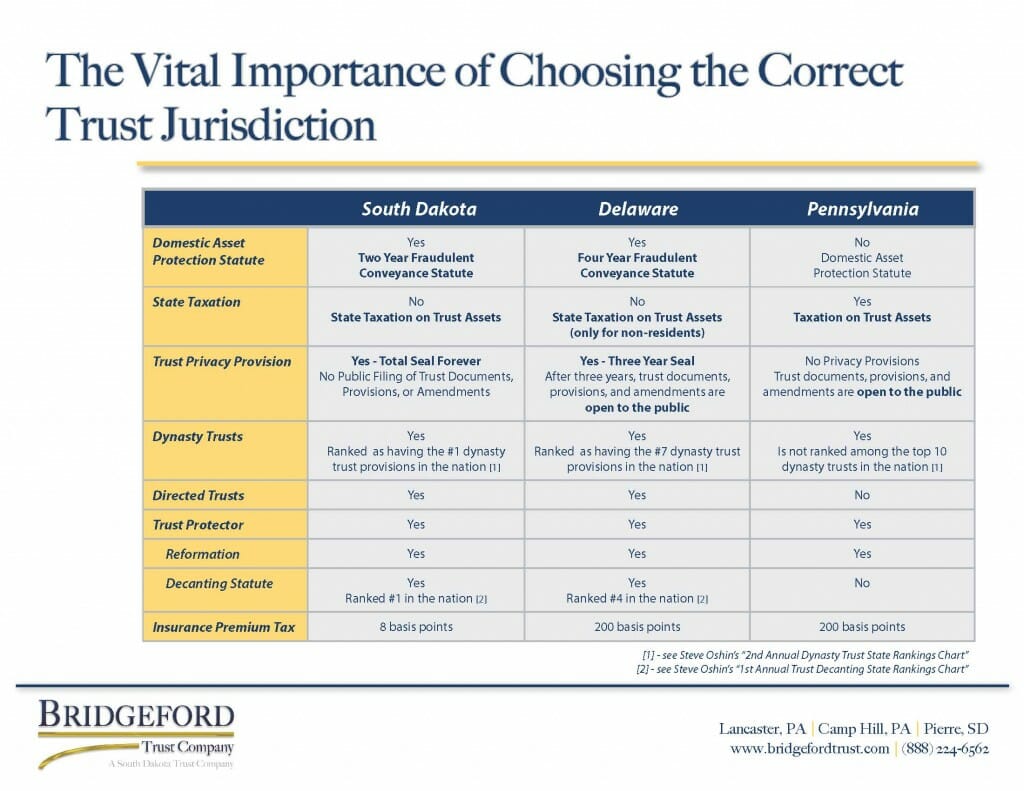

The chart below, produced by Bridgeford Trust Company, presents a very clear comparison of important factors that should be considered when comparing South Dakota, Delaware, and Pennsylvania as a potential trust jurisdiction. These factors are particularly important for planners to consider when determining the most robust dynasty trust state, the most compelling asset protection statute and privacy provisions, as well as the state with the most advantageous tax treatment for clients. The chart again accentuates the vital importance of considering alternative trust jurisdictions in the wealth and trust planning process to ensure that clients are availing themselves of the most progressive trust laws in the country.

Click on the image below to view the chart in a larger, PDF format.

For more information about the importance of considering alternative trust jurisdictions in the planning process and the power of South Dakota law, please feel free to contact us via our contact page.