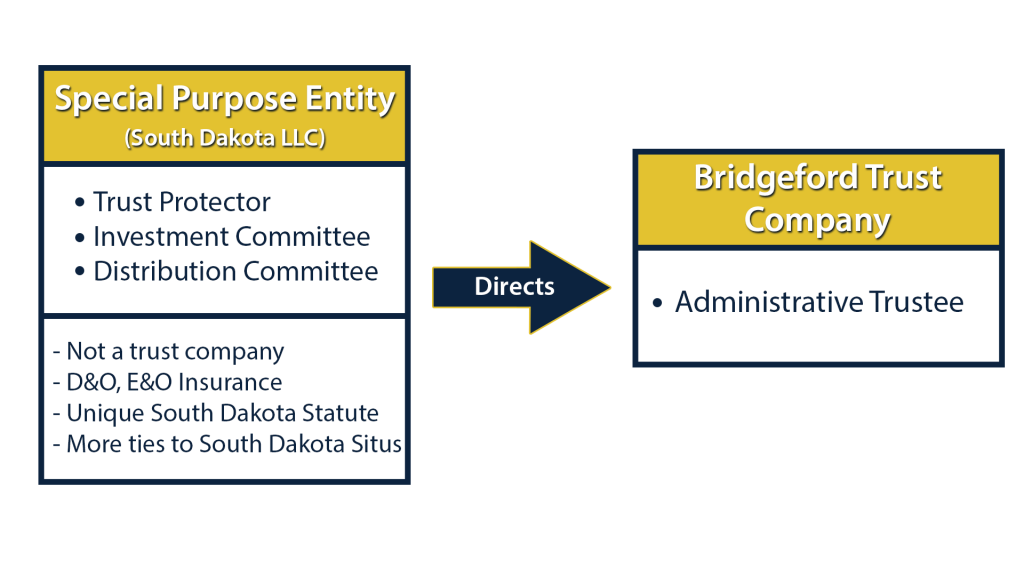

The special purpose entity is a powerful planning tool because it places a liability umbrella over the individuals filling the roles of trust protector, investment committee, and/or distribution committee, therefore protecting them from personal claims connected to their actions in this capacity. Essentially, direction comes from a South Dakota entity and not from any one individual. Equally as important, the special purpose entity concept can be used to destroy nexus between in state trust protectors, investment committee members, and/or distribution committee members, therefore maintaining the jurisdictional integrity of a resident trust with situs in a progressive trust jurisdiction like South Dakota.

South Dakota is the only state with a special purpose entity statute. The sole purpose of the special purpose entity is to direct an administrative trustee, such as Bridgeford Trust, relative to trust investments, distributions, and trust protector functions within the directed trust framework. Click here for a detailed discussion about the directed trust concept and how it is changing the trust industry.

South Dakota is the only state with a special purpose entity statute. The sole purpose of the special purpose entity is to direct an administrative trustee, such as Bridgeford Trust, relative to trust investments, distributions, and trust protector functions within the directed trust framework. Click here for a detailed discussion about the directed trust concept and how it is changing the trust industry.

The special purpose entity is an important planning tool as it supports and encourages the benefits associated with selecting progressive jurisdictions for trust situs, such as South Dakota, in the wealth and trust planning process. Click here to review the Advantages of South Dakota Trust Law.

Knowledge and understanding of the special purpose entity is just another example of how crucial selecting proper trust situs has become when developing wealth and trust plans for clients. Click here to view the South Dakota’s special purpose entity statute in its entirety.

For more information about special purpose entities, please contact Bridgeford Trust via our contact page.

Bridgeford Trust invites you to join us for a complimentary CLE/CPE training and mixer on October 8 at The Millworks in Harrisburg! There will be a very relevant and timely discussion about cutting edge modern trust law concepts that have a big impact on trust planning, as well as a great networking opportunity among the CPA and legal communities.

Bridgeford Trust invites you to join us for a complimentary CLE/CPE training and mixer on October 8 at The Millworks in Harrisburg! There will be a very relevant and timely discussion about cutting edge modern trust law concepts that have a big impact on trust planning, as well as a great networking opportunity among the CPA and legal communities. Directed Trusts, only available in a handful of states across the country including South Dakota, continue to drastically change the trust world through unbundling asset management and trust administration functions, putting control back into the hands of settlors, beneficiaries, and their advisors.

Directed Trusts, only available in a handful of states across the country including South Dakota, continue to drastically change the trust world through unbundling asset management and trust administration functions, putting control back into the hands of settlors, beneficiaries, and their advisors. Bridgeford Trust is proud to be co-sponsoring the Philadelphia Estate Planning Council’s Ethics Forum on April 22, 2015. David Warren, President and CEO, is delivering an introduction and discussion comparing trust jurisdictions and the vital importance of selecting the proper trust situs in the wealth planning process.

Bridgeford Trust is proud to be co-sponsoring the Philadelphia Estate Planning Council’s Ethics Forum on April 22, 2015. David Warren, President and CEO, is delivering an introduction and discussion comparing trust jurisdictions and the vital importance of selecting the proper trust situs in the wealth planning process. Bridgeford Trust is proud to once again be sponsoring

Bridgeford Trust is proud to once again be sponsoring  South Dakota is AGAIN ranked as having the top decanting statute in the nation. Published by Nevada attorney Steve Oshins, the new

South Dakota is AGAIN ranked as having the top decanting statute in the nation. Published by Nevada attorney Steve Oshins, the new  Privacy has always been of paramount concern to wealthy families and is one of the primary reasons why billions of dollars have been and are being moved into South Dakota for trust administration from around the globe. Most states do not have provisions or laws protecting trust information from being revealed to beneficiaries or to the public during litigation. Furthermore, the few trust privacy laws in existence in the United States are not “created equally”, making it vitally important for clients and their advisors to understand which state trust jurisdiction offers the best and most powerful privacy protection. For the reasons outlined below, South Dakota clearly has the most robust privacy provisions in the nation rendering that state the trust jurisdiction of choice for wealthy families from all over the world.

Privacy has always been of paramount concern to wealthy families and is one of the primary reasons why billions of dollars have been and are being moved into South Dakota for trust administration from around the globe. Most states do not have provisions or laws protecting trust information from being revealed to beneficiaries or to the public during litigation. Furthermore, the few trust privacy laws in existence in the United States are not “created equally”, making it vitally important for clients and their advisors to understand which state trust jurisdiction offers the best and most powerful privacy protection. For the reasons outlined below, South Dakota clearly has the most robust privacy provisions in the nation rendering that state the trust jurisdiction of choice for wealthy families from all over the world.  Decanting has emerged as a very compelling planning option for advisors across the nation. Appropriately referred to as a “do over”, decanting is essentially distributing assets from an irrevocable trust into a new trust with different, and presumably more desirable and flexible, terms leaving the unwanted terms in the original trust and not binding on the assets.

Decanting has emerged as a very compelling planning option for advisors across the nation. Appropriately referred to as a “do over”, decanting is essentially distributing assets from an irrevocable trust into a new trust with different, and presumably more desirable and flexible, terms leaving the unwanted terms in the original trust and not binding on the assets.  This webinar entitled “Not Your Grandfather’s Corporate Trustee: Modern Trust Laws and the Resurgence of the Corporate Trustee” was originally produced on November 18, 2014. We hope you enjoy the full recording and additional materials below. This webinar was hosted by David Warren, President and CEO with Bridgeford Trust Company, and Tyler Wenger from McKonly & Asbury.

This webinar entitled “Not Your Grandfather’s Corporate Trustee: Modern Trust Laws and the Resurgence of the Corporate Trustee” was originally produced on November 18, 2014. We hope you enjoy the full recording and additional materials below. This webinar was hosted by David Warren, President and CEO with Bridgeford Trust Company, and Tyler Wenger from McKonly & Asbury.