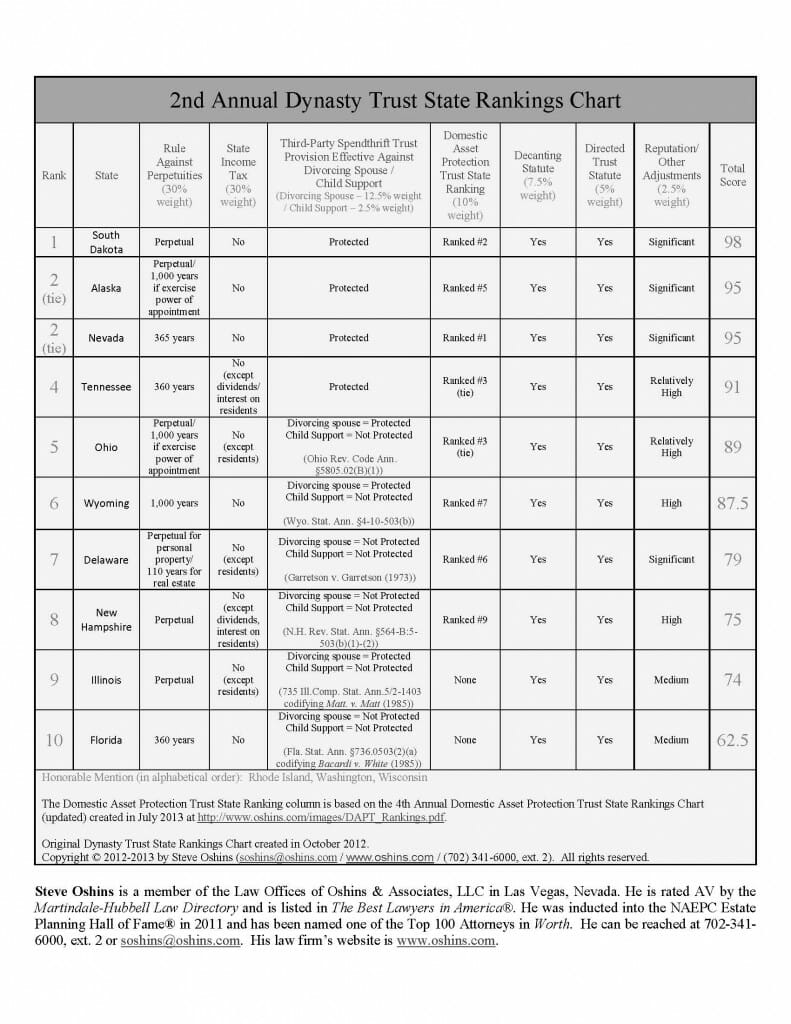

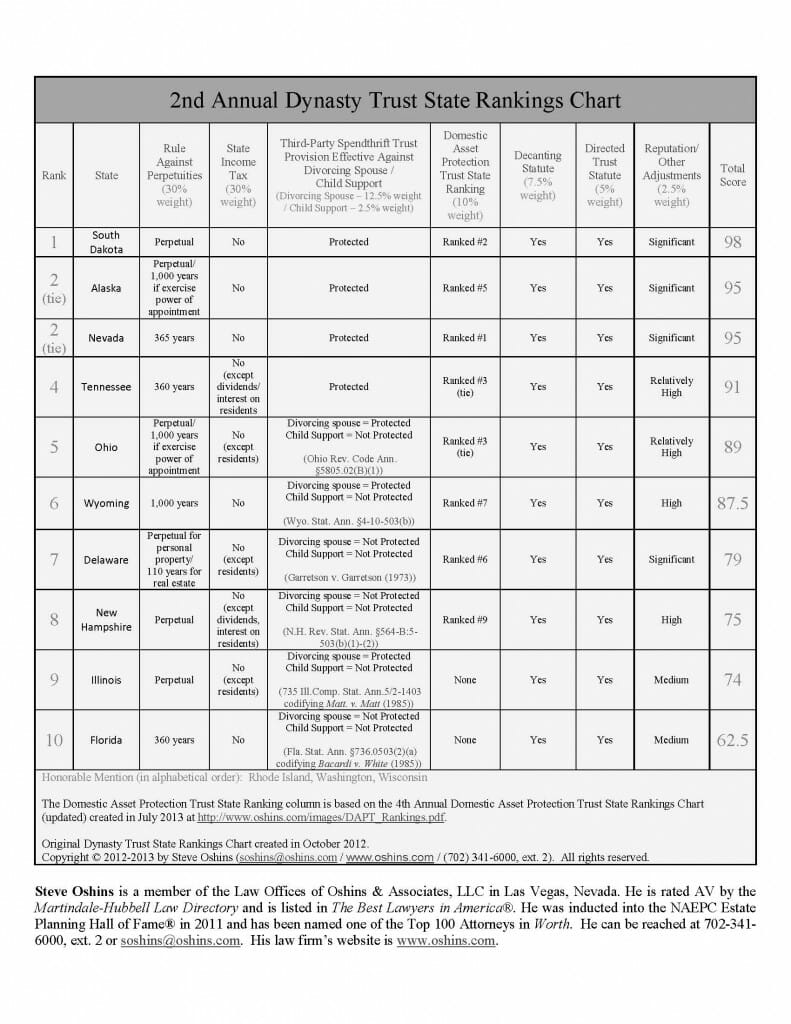

Proving once again that trust situs matters, South Dakota (for the 2nd year in a row) is ranked the top dynasty trust state while Delaware slips again this year to the seventh position behind Ohio and Wyoming. The rankings chart, an annual ranking of dynasty trust states from across the country published by Nevada attorney Steve Oshins, is an excellent resource for advisors and clients because of the methodical and objective approach to evaluating the factors that impact the viability of dynasty trusts states such as whether they have an asset protection statute and how effective it is in comparison to other states. In addition, the chart considers state taxation on trusts and whether the state has directed trust and decanting statutes.

The chart accentuates the vital importance of considering alternative trust jurisdictions in the wealth and trust planning process to ensure that clients are availing themselves of the most progressive trust laws in the country, particularly in the area of dynasty trust formation, which continues to be a very hot topic.

An important factor to consider relative to whether a dynasty trust state is the best for clients, not considered in Steve Oshins’ chart, is privacy. States have different privacy provisions protecting information contained in a trust from becoming public. Pennsylvania has no privacy provision and, after three (3) years, trust information can become public in Delaware. South Dakota is the only dynasty trust state that has a total seal on trust information forever. Clearly, this is also an important factor to consider when determining where to place a trust in the wealth planning process.

Steve Oshins’ chart can be viewed by clicking on the image below.

If you have any questions, please feel free to contact us via our contact page.

Bridgeford Trust is honored and thrilled to be featured in a recent Central Pennsylvania Business Journal article entitled,

Bridgeford Trust is honored and thrilled to be featured in a recent Central Pennsylvania Business Journal article entitled,

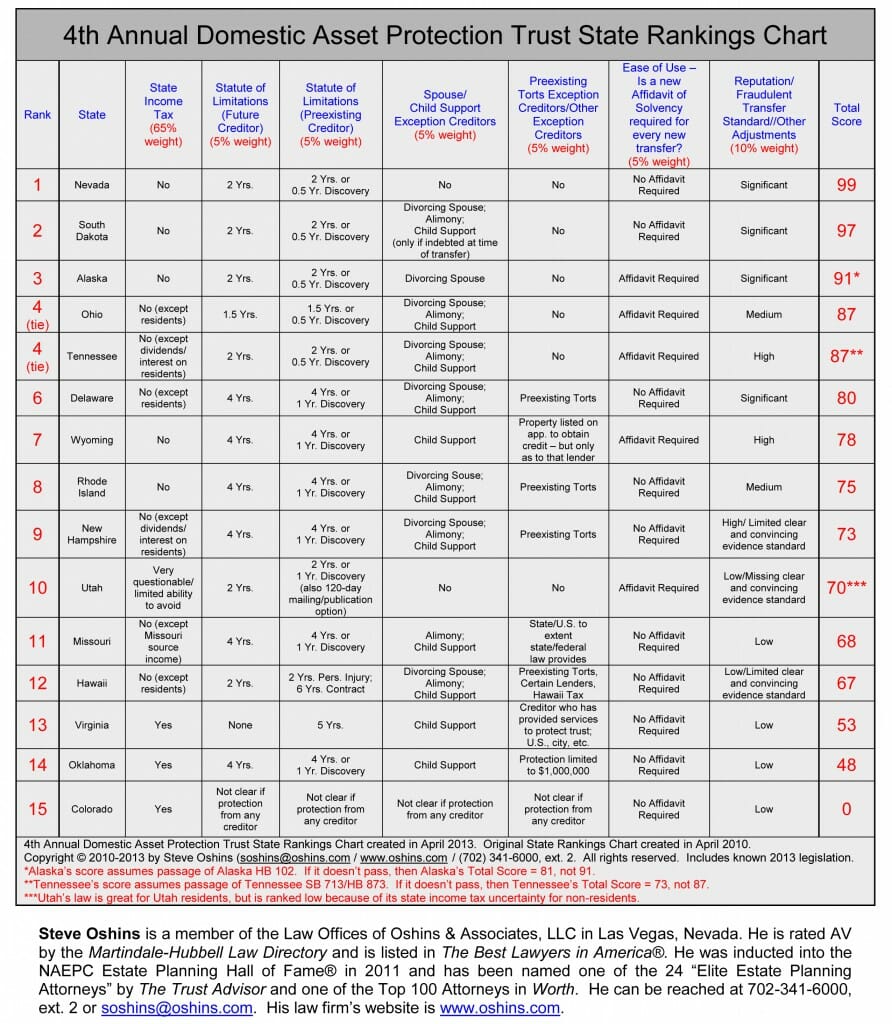

Domestic Asset Protection Trusts are a compelling planning tool to use in lieu of or in conjunction with prenuptial agreements in the pre-marital planning process. While prenuptial agreements serve a certain purpose, there are many personal and legal issues that deter couples from executing them, and as such, many practitioners have turned to alternatives to protecting assets obtained prior to marriage.

Domestic Asset Protection Trusts are a compelling planning tool to use in lieu of or in conjunction with prenuptial agreements in the pre-marital planning process. While prenuptial agreements serve a certain purpose, there are many personal and legal issues that deter couples from executing them, and as such, many practitioners have turned to alternatives to protecting assets obtained prior to marriage.  Below is a link to a recent Pennsylvania Commonwealth Court opinion (McNeil v. Commonwealth of Pennsylvania, Pennsylvania Commonwealth Department of Revenue) rejecting the Pennsylvania Department of Revenue’s attempt to impose an income tax on “resident trusts.” A resident trust is one created under the will of a decedent who was a Pennsylvania resident at the time of death or a lifetime “grantor” trust established by a Pennsylvania resident. Regardless of where the trust is sitused (which state has jurisdiction), under Pennsylvania law, the trust remains subject to Pennsylvania income tax even if the settlor, trustee, or beneficiaries do not have any contact with Pennsylvania.

Below is a link to a recent Pennsylvania Commonwealth Court opinion (McNeil v. Commonwealth of Pennsylvania, Pennsylvania Commonwealth Department of Revenue) rejecting the Pennsylvania Department of Revenue’s attempt to impose an income tax on “resident trusts.” A resident trust is one created under the will of a decedent who was a Pennsylvania resident at the time of death or a lifetime “grantor” trust established by a Pennsylvania resident. Regardless of where the trust is sitused (which state has jurisdiction), under Pennsylvania law, the trust remains subject to Pennsylvania income tax even if the settlor, trustee, or beneficiaries do not have any contact with Pennsylvania.  For several years, South Dakota has been considered by many commentators and planners to be the best trust jurisdiction in the nation because of its cutting edge laws around asset protection, dynasty and directed trusts, and privacy. Proving once again that jurisdiction matters and is not to be ignored in the wealth and business planning process, recently South Dakota was ranked the best state in the nation within which to do business according to CNBC. You can view the CNBC article here:

For several years, South Dakota has been considered by many commentators and planners to be the best trust jurisdiction in the nation because of its cutting edge laws around asset protection, dynasty and directed trusts, and privacy. Proving once again that jurisdiction matters and is not to be ignored in the wealth and business planning process, recently South Dakota was ranked the best state in the nation within which to do business according to CNBC. You can view the CNBC article here: